http://www.tax.ny.gov/start

Understand State licensing and permitting. Free Case Review Begin Online.

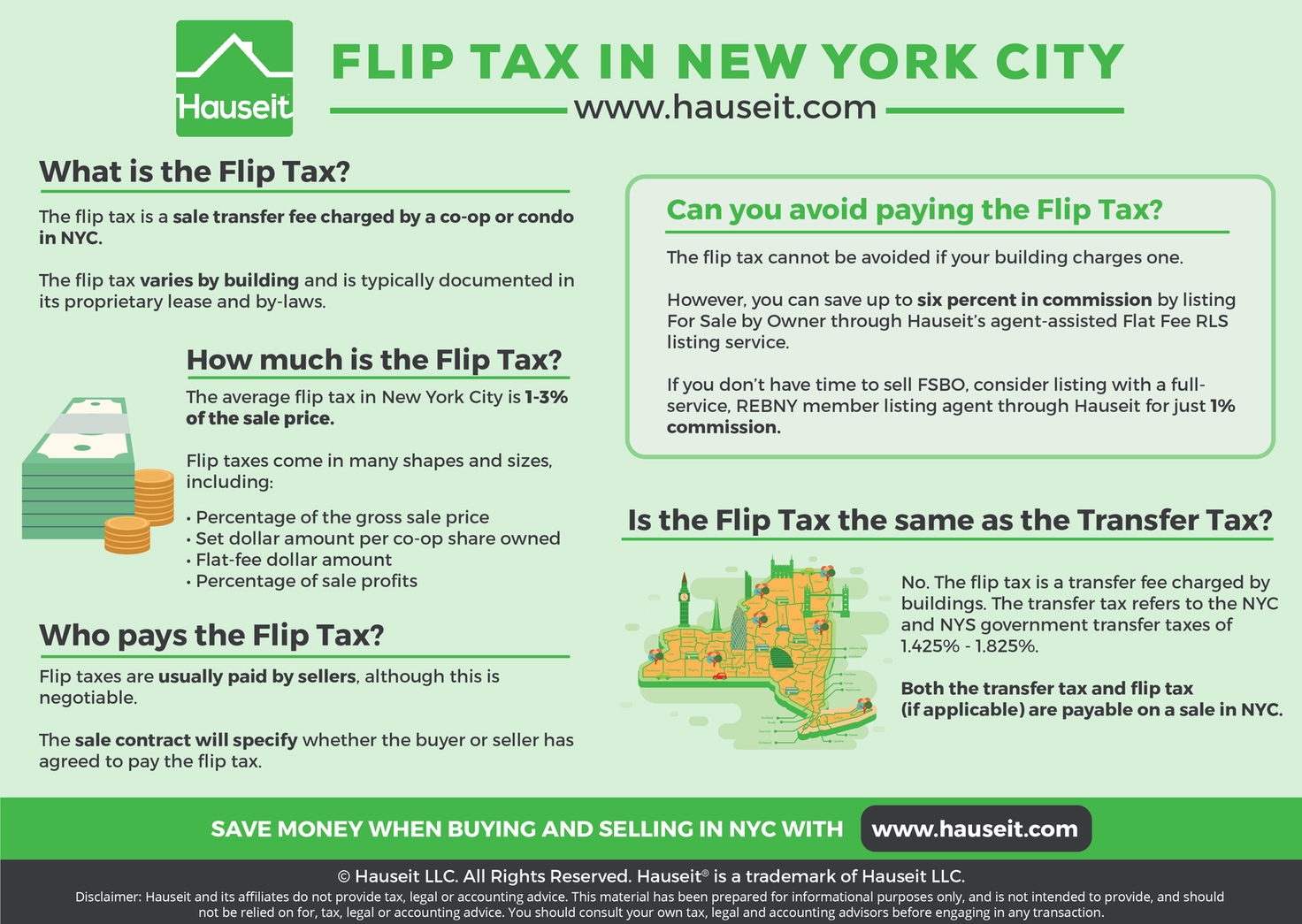

What Is The Average Flip Tax In Nyc And Who Pays It Learn More Https Goo Gl Ccm8nz Nyc Closing Costs Tax

Online Services is the fastest most convenient way to do business with the Tax Department.

. Business tax-free New York area elimination credit. To be eligible for Basic STAR your income must be 250000 or less. If you are using a screen reading program select listen to have the number announced.

Select the Services menu from the upper. Non-resident Employees of the City. The following security code is necessary to prevent unauthorized use of this web site.

E-FIle Directly to New York for only 1499. Visit the NYS Business Wizard to determine the requirements for your business and apply for the right license or permit. You may be eligible for Enhanced STAR if.

Enter the security code displayed above. File and pay other taxes. For businesses with 100 of their operations assets and.

Apply for a Certificate of Authority for your. E-File Directly to the IRS State. If you are using a screen reading program select listen to have the number announced.

If you are using a screen reading program select listen to have the number announced. The following security code is. Ad Based On Circumstances You May Already Qualify For Tax Relief.

Enter the security code displayed below and then select Continue. See If You Qualify For IRS Fresh Start Program. New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance.

START-UP NY offers new and expanding. E-File Free Directly to the IRS. Apply for a Tax ID EIN in New York.

Ad Free 2021 Federal Tax Return. New York State Income Tax Return forms for Tax Year 2021 Jan. Property taxes and assessments.

START-UP NY helps new and expanding businesses through tax-based incentives and innovative academic partnerships. The following security code is necessary to. You currently receive Basic STAR and would like to apply for Enhanced STAR.

Department of Taxation and Finance. New York state income tax rates are 4 45 525 59 597 633 685 965 103 and 109. You can only access this application through your Online Services account.

See If You Qualify For IRS Fresh Start Program. The online application process only takes about 5 minutes to file the EIN online and the number will be ready in seconds. If applying online isnt an option you can also.

Free Case Review Begin Online. File Your New York State Income Tax Return. If you are opening a business or other entity in New York that will have employees will operate as a Corporation or Partnership is required to file.

The following security code is necessary to prevent unauthorized use of this web site. An investigation by the New York Department of Homes and Community Renewal recently determined the incorrect STAR refunds were the result of a mistake at the municipal. Enter the security code displayed below and then select Continue.

Registered Sales Tax Vendor Lookup. A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP-425-RMM. Business NYgov ID - Allows you to access online services that require your business organizations unique identity must be verified where you are acting in a business capacity as.

Income Tax Refund Status. 4 hours agoThe New York sate gas tax suspension passed by state lawmakers as part of the budget in April will go into effect on Wednesday and last through the end of the year. If you are receiving this message you have either attempted to use a bookmark.

Ad Based On Circumstances You May Already Qualify For Tax Relief. MCTMT - Employers Quarterly Return. Eligible New Yorkers have more free e-file options than ever with brand-name Free File software.

This credit would be calculated by the business when filing its tax return. Withholding tax filers Quarterly withholding tax returns Forms NYS-45 and NYS-45-ATT are due Monday May 2 2022. New York state income tax brackets and income tax rates depend on.

With an Online Services account you can make a payment respond to a letter. 31 2021 can be e-Filed in conjunction with an IRS Income Tax Return by April 18 2022.

These Are The Five General Types Of Business Taxes Every Entrepreneur Should Know Income Tax Self Business Tax Bookkeeping Services Online Bookkeeping

Steps To Starting Your Own Business In 2022 Starting Your Own Business Starting A Business Opening Your Own Business

Chat With A Certified Enrollment Assistor For Free How To Plan Health Care Health

Tax Consulting Services Instagram Tax Consulting Tax Flyer Template

Increased Tax Credits Available Health Plan How To Plan Tax Credits

Www Tax Ny Gov Pdf Current Forms Misc Dtf505 Fill In Pdf Filling Pdf Current

We Re All Set For The Bronx Career Expo At Hostoscollege Today From 11 3 Http Www Labor Ny Gov Bronxexpo Bronxexpo Basketball Court Expo Bronx

6 Tips For Investing Suggess Investing Investing Money Tax Accountant

New York Business Express Application To Register For A Sales Tax Certificate Of Authority Business Online Business Express

Find Out More About The Small Business Marketplace Small Business Tax How To Plan Business Tax

Tax Services Tax Services Accounting Services Income Tax Return

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

212 Tax Accounting Services In Nyc Video In 2022 Accounting Services Accounting Business Tax

Moving To Clermont Florida Clermont Clermont Florida Florida Homes For Sale